According to a recent poll conducted by Suze Orman’s company SecureSave, 67% of Americans do not have enough money saved to meet a $400 emergency. Furthermore, more than half of respondents (54%) indicated their savings had fallen in the previous year.

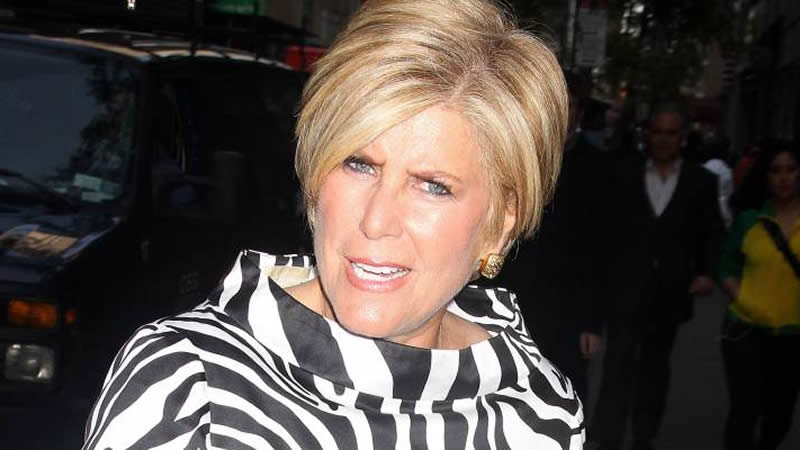

“This data is a huge red flag for our country’s economy: the overwhelming majority of American households are dangerously unprepared,” Orman said in a press release for the study.

Orman has seen the snowball effect several times throughout her career. Here’s what it is and how you may avoid it happening to you.

There are some shocking data on how Americans manage financial emergencies.

According to the Federal Reserve, one-third of Americans will be unable to handle a $400 emergency bill in 2021.

the figure rose to 67% in 2022, according to SecureSave’s poll, and just around one-third of Americans could pay the $400 without using credit cards or taking out a loan.

Orman warns big difficulties might arise when you have to use your credit cards or draw into your 401(k) to meet unforeseen obligations.

It’s one of the reasons she co-founded SecureSave, a firm that helps people save for emergencies through their job, tap to a 401(k).

Orman, the author of many personal finance books and host of the Women & Money Podcast talked with Moneywise in November on the importance of emergency funds.

“It’s yours and sometimes things happen in life and you should have a little account that’s just yours that nobody can get … just to keep you safe and sound.”

The snowball effect in action

Putting emergency expenses on a credit card may result in you paying far more than you would have if you had paid it in cash to begin with, and here is where the snowball effect comes into play.

Orman uses the example of a car’s battery dying to show what may happen.

“And I said, ‘and how much does that cost you?’ She said, ‘Well, I’m putting it on my credit card.’”

Orman told Moneywise about a woman she knew who was in this situation because her battery died, her car broke down, and she had to rely on Ubers to get around.

“And it’s gonna get worse for her as well. I said, ‘Why didn’t you pay the tickets when you got the tickets?’ She said ‘I didn’t have the money to pay the tickets.’

According to Orman, the woman’s car was towed and she had to pay traffic fines before she could have it back. The woman owed $1,100 and yet didn’t have her car back in working order.

Save what you can

In a recent blog, Orman repeated her mantra on the need for savings.

“Your goal should be to have one year of living costs set aside in a savings account at a federally insured bank or credit union.”

With inflation at its greatest in decades, no one can deny how tough it is to save right now, but it is also vital.

In general conditions, experts recommend saving up three to six months’ worth of living costs.

While it may be difficult for many Americans, Orman told Yahoo that starting small is better than not saving at all.

“Listen, $10 is better than nothing. $50 is better than $10, $100 is better than $50. Because really, sometimes $200, $400 can make a world of difference in your situation.”

She says it’s never too late to start your “freedom account”.

“Once you start saving, and you look at it, it’s like ‘Oh my God, I like it. I like it. It’s not only easy, I don’t miss it.”